Our AI is Proving its Worth in Difficult Markets

Inflation. The Fed. Invasion of Ukraine. China Shutdown. More inflation, more Fed.

The first half of 2022 was pretty tough on most investors—from DIYers to professional fund managers.

Three common industry viewpoints for times like these:

- This is when active managers should be outperforming passive strategies.

- This is when bond allocations should protect investors from falling stocks.

- This is when automated data-driven strategies—quant strategies, machine learning—tend to break down.

The reality is a little more nuanced: some active managers make the right calls, but many don’t … even smart, experienced ones with otherwise good track records. Bonds completely failed to protect investors from stock market losses. And as for data-driven strategies, we’re pretty happy with how PSIMON, our predictive analytics platform, managed the challenging first half of 2022.

One of the key concepts that separates PSIMON from other AI strategies is that we’ve designed it to recognize regime changes in the markets, and to adapt quickly when markets shift. That’s not an easy task, and our platform got a great test in late February, when Russia invaded Ukraine, disrupting commodities markets and exacerbating already growing inflation issues. The dominant forces in the markets changed very quickly.

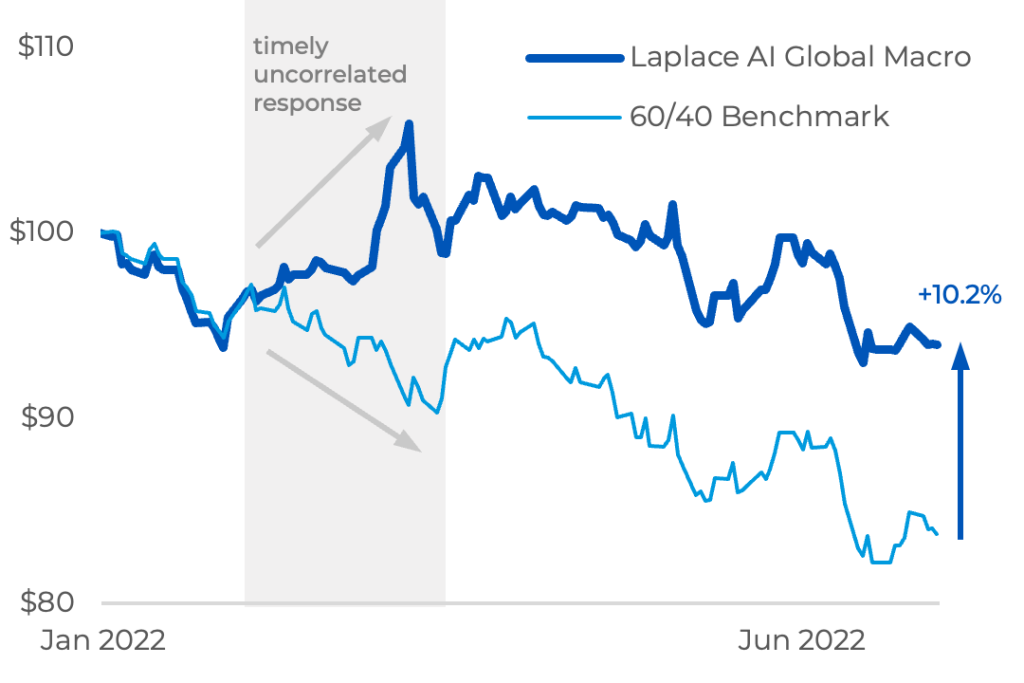

As at June 30, 2022, the value of $100 invested at the beginning of 2022 in in a traditional 60/40 portfolio was $83.78 vs $93.98 for the Laplace AI Global Macro portfolio.

PSIMON is adaptable to many strategies, but our longest-running example is our AI global macro strategy. It allows for tactical allocation among 15 low-cost ETFs (that act as proxies for major asset classes). Of note, it only trades once-a-month.

Throughout a relatively stable 2021, the portfolio had significant exposure to the S&P 500 (alongside meaningful allocations to real estate, and some shorter term, timely allocations to commodities). At the end of January, that all changed quickly. Throughout February and March, the portfolio boldly reallocated. In human terms, it seemed to go from “consensus” investor to “contrarian” almost overnight, but, of course, this is one of the advantages of a platform like PSIMON: it’s not attached to any style, thesis or individual holding. Instead, it analyzes both current and historic data to construct a probabilistic view of the near-term future, and moves tactically to avoid losses and find alpha.

As you can see in the chart above, the portfolio was wonderfully uncorrelated with its benchmark in February, March and even through much of April. June was a brutal month for many investors, and while we did a little better than most, PSIMON predicted a better month for bonds than turned out to be the case. On the positive side, it has been taking part in the US dollar’s run-up and increased that exposure into July.

The bottom line is that the stakes are high for portfolio managers, and while advanced predictive technologies promise to help, they need to prove themselves in the crucible of difficult markets. We’re quite happy with how PSIMON performed through the rocky first half of 2022, as it outperformed its benchmark— 60/40 —by over 10% in only 6 months. We’re excited to see how it performs—and the investment decisions it makes—in the second half.